Source: Kate Burke, Journalist, Domain

Unit prices across Sydney have increased 2.6 per cent in the past three months, new data shows, despite fears about construction defects across Sydney, increased supply and weaker buyer demand.

The city's median unit price is now $694,840, with gains in the northern beaches, lower north shore, inner west, city and east, south west and upper north shore, the Domain House Price Report for the September quarter shows.

JLL Australia's head of residential research, Leigh Warner, said increased supply putting downward pressure on prices was unlikely to last much longer.

“[Supply] is probably at around the peak … and it will fall away quite sharply,” Mr Warner said. “There's residual stock to soak up around Sydney, [but] it's not a huge oversupply in the broader perspective.”

Hitting pre-sale targets to secure funding remained the biggest challenge for developers, Mr Warner said, particularly for large projects – with demand further weakened by the evacuations of the Opal and Mascot Towers and concerns about combustible cladding.

“I think it's definitely had an impact … in terms of dampening confidence towards new builds, particularly where it's a third and fourth-tier developer and builder,” he said.

Mr Warner said a massive decline in building approvals – down 50 per cent since their peak – was due to weaker demand and funding challenges for developers. This means Sydney would likely shift to undersupply within two years given the city's population continues to climb.

Plans were submitted for just two large apartment projects in inner Sydney in the September quarter, his research found.

Demand for development sites that can become high-density apartment projects across Sydney has plummeted. This week's latest Knight Frank Australian Residential Development Review revealed city-wide sales halved from the 2017-18 financial year to just under $2 billion.

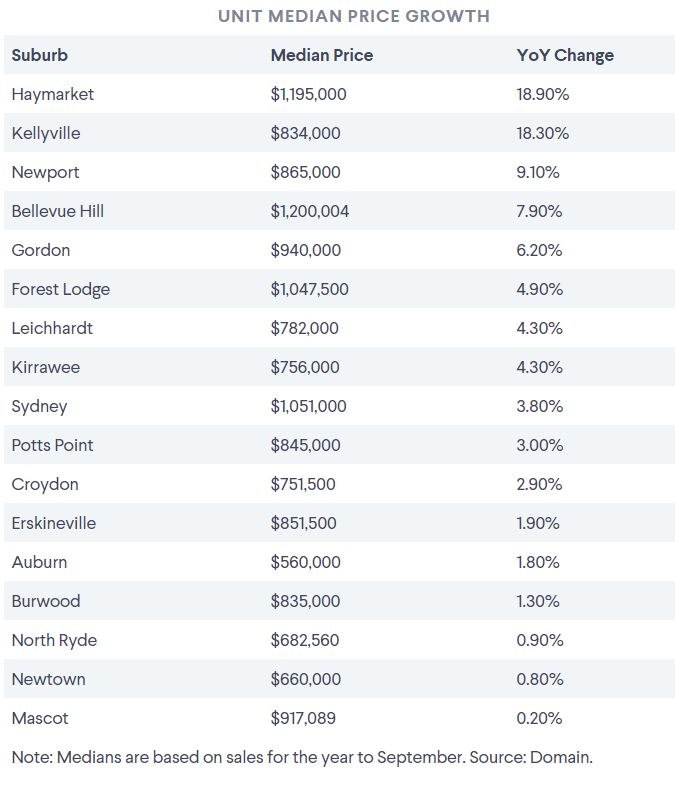

Prices increased in the year to September in 17 of 147 suburbs that recorded a median unit price, new Domain data shows. Haymarket had the highest increase at 18.9 per cent, followed by Kellyville and Newport at 18.3 and 9.1 per cent. The majority of price gains were in the city and eastern suburbs or inner west.

Most returned to growth after seeing heavy price falls over 2017 and 2018, said Domain research analyst Eliza Owen.

“Some of these areas have seen a lot of new supply, which may be pushing up the median because you're introducing newer, more expensive homes,” Ms Owen said. “As unit prices have bottomed out … people might be trading up. So medians start to reflect something, bigger, newer or nicer.”

Increased conservatism among lenders, which did not exist during the last upswing, was likely to determine the areas that rebounded first, Ms Owen said.

“It will be more expensive areas and people that have more money,” she said. “Most of them are pretty high value areas; they sit well above the city median.”

Buyers' agent Peter Kelaher of PK Property said buyers were wary of new apartments despite the recent bump in market confidence.

“Investors have definitely come back … and a lot of people are rushing in and buying apartments,” Mr Kelaher said. “[But] without a doubt they're cautious of new properties.”

Buyers' appetite for new apartments has slipped, with views per listing for new apartments down 9.2 per cent in the first half of 2019, Domain data shows. Views on established apartments increased 2.7 per cent.

“While there is definitely caution around new apartments and particular markets … units present a relatively affordable housing option … long-term demand is still going to be there,” Ms Owen said

It was a key factor behind demand for Bellevue Hill apartments, which increased 7.9 per cent to a median of about $1.2 million, said selling agent Charlie Beaumont of Phillips Pantzer Donnelley.

“We are seeing growth in the amount of people coming through more established homes,” said Mr Beaumont.

Stock shortages in the eastern suburbs, interest rate cuts, eased lending restrictions and the return of investors post-election were other keys factors that brought confidence back to the market, Mr Beaumont added.

Price gains are welcome news for Belinda Gamble and Nick Read, who put their two-bedroom art deco apartment in Bellevue Hill on the market this week, to upgrade their young family to a larger home.

“We were only going to sell post-election, we wanted to see what would happen and obviously now that interest rates are low it's a perfect time for us to buy as well,” Ms Gamble said.

“It felt like the right time with growing market confidence,” added Mr Read. “[But] we're very glad we are selling a tried and tested art deco apartment that has been standing strong since the 1930s.”

The Victoria Road apartment is scheduled for auction on November 16 with a price guide of $850,000 to $900,000.