Source: CHRIS KOHLER, Domain

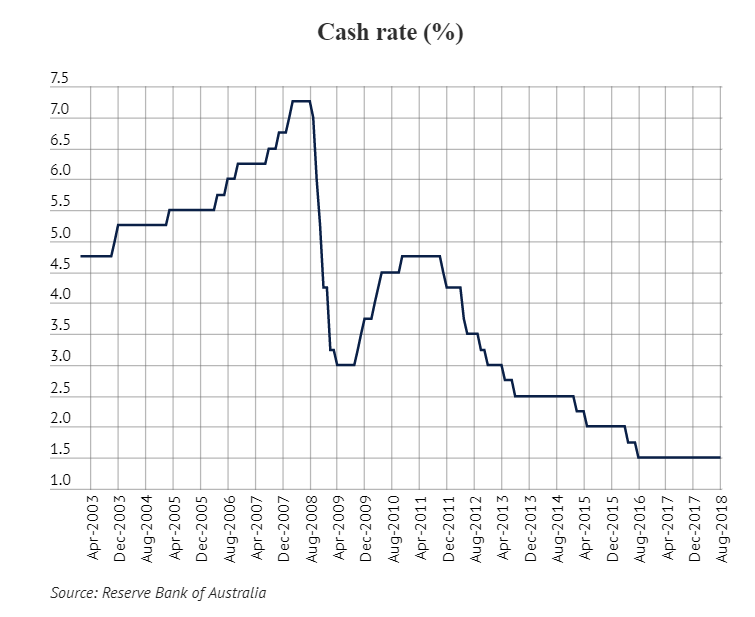

The Reserve Bank cash rate for August has been left on hold for a record 22nd consecutive time, and, while economists continue to predict a rate increase will follow the lengthy wait, there is a “rising risk” the opposite could occur.

Since its July meeting, RBA governor Philip Lowe and the board – which meet 11 times a year – have seen property prices in Sydney and Melbourne slide further, a weaker than expected quarterly inflation report, and further mortgage rate repricing among banks.

The data will keep the central bank on the sidelines well into the future. While most economists remain confident the next move will be an increase, AMP Capital chief economist Shane Oliver says there is a “significant chance” the bank will cut the rate.

“With falling home prices set to drive a negative wealth effect, it's hard to see the RBA raising rates anytime soon and if anything there is a significant chance that the next move will be a rate cut,” Dr Oliver wrote before the RBA's August meeting on Tuesday.

Property puts a dampener on increase plans

For the most part, the economic community predicts the next move from the RBA will be a rate increase. Little consensus exists, however, when that will happen.

HSBC chief economist Paul Bloxham predicts an increase in the second quarter of next year, ANZ's head of Australian economics David Plank forecasts at least one in the second-half of 2019, and Capital Economic chief Australian economist Paul Dales points to a higher rate in “late 2019”. UBS economist George Tharenou sees the rate on hold until 2020.

A “stand-off” will see rates on hold well into the future, Dr Oliver said.

“The RBA's own forecasts for decent growth and a gradual rise in inflation, along with strong infrastructure investment, rising business investment and strong export volumes argue against a rate cut,” Dr Oliver said.

“But the peak in the housing construction cycle, uncertainty about the outlook for consumer spending, the weakening Sydney and Melbourne property markets, low inflation and wages growth and tight bank lending standards all argue against a rate hike.

“So, the stand-off continues and the RBA will remain on hold.”

And while agreeing the next move from the RBA is still “likely to be up, but not until 2020 at the earliest”, Dr Oliver says there is a rising risk the next move will be a cut.

Mortgage market turbulence continues

And while the RBA has remained on the sidelines, Australian lenders have taken mortgage rates in both directions.

Small to mid-sized banks such as Bank of Queensland, Suncorp, AMP and ME have lifted mortgage rates in response to higher funding costs.

But Australia's third-largest lender, ANZ, made headlines last week for cutting its standard variable mortgage rate for low-risk borrowers.

ANZ announced it would offer a 3.65 per cent variable interest rate to new customers with a deposit of more than 20 per cent. Existing customers were not eligible.

Banking analysts had expected the big four to follow smaller lenders into mortgage rate increases, but now predict ANZ's move heralds an attack on market share.