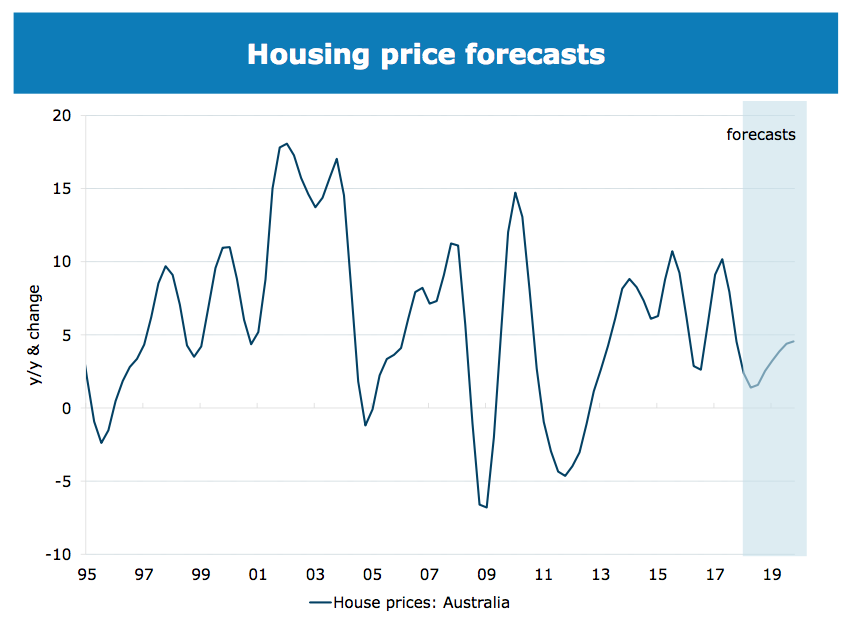

According to senior ANZ economists, the news for the Australian housing market is good, putting outright price falls "off the table", and predicting prices to push modestly higher this year and set to ramp up in 2019.

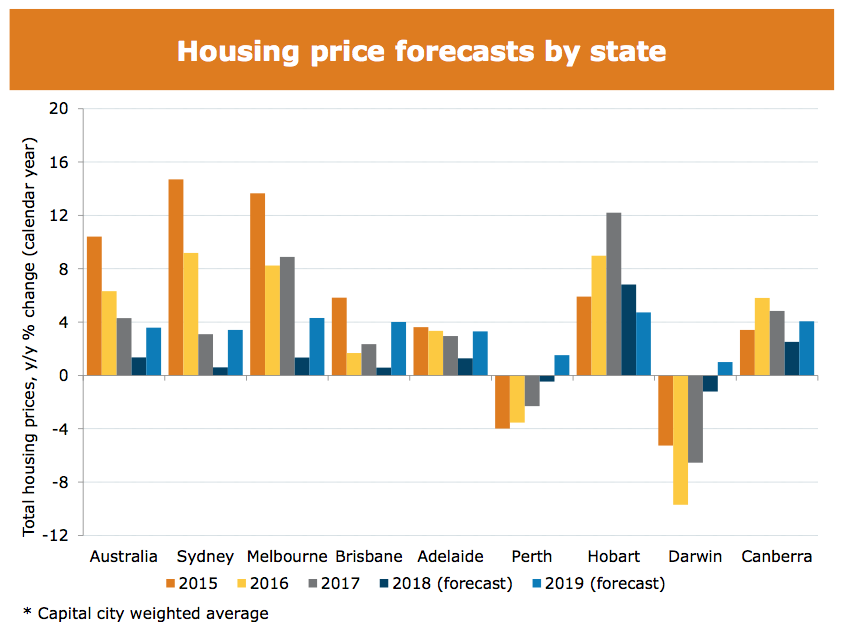

National house prices are still up 0.8% higher than they were 12 months ago, and ANZ is forecasting total growth of 1.8% across the country this year, picking up to 3.6% growth in 2019, with Melbourne and Hobart leading the charge.

“

"We think most of the slowdown has already occurred,” senior ANZ economists Daniel Gradwell and Joanne Masters. wrote this week. “We retain our view that prices will not materially decline."

This is a new market, and the days of double digit growth figures are over, but their figures still indicate growth in prices, which is good news for homeowners and purchasers alike.

So this begs the question: what is driving this growth? The answer? Australia's strong labour market, rising incomes and low official interest rates. Consumer confidence has also remained above trend, and building activity has also outstripped expectations.

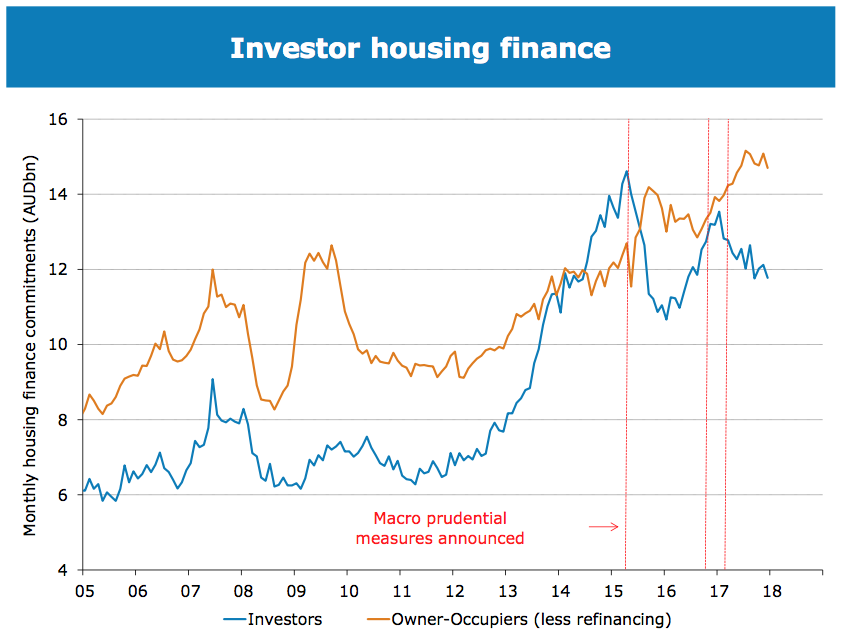

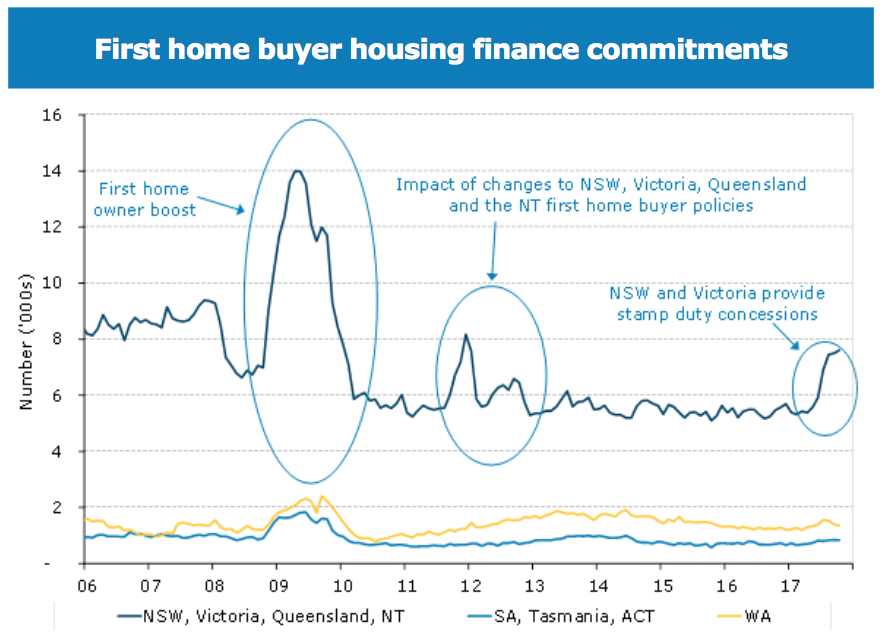

There has been much commented in the media about the impact of tighter investment regulations on the number of purchasers within the market, however ANZ's data is showing that to a large extent this "hole" is being "replaced by first-home buyers, who are enjoying stamp duty discounts in New South Wales and Victoria.”

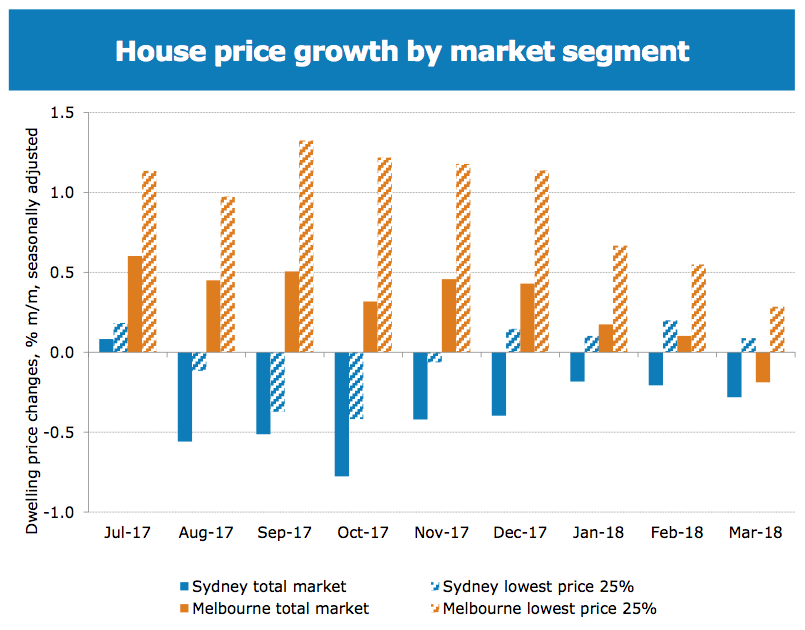

That means growth is strongest in the lower-end of the market. Which is something I have been seeing and saying for a while. The "market" is incredibly segmented, and to truly understand what's happening you need to break it down and analyse each part, not just look at the sum of all the parts together as they can tell a conflicting and confusing story.

When asked their prediction on a potential interest rate rise this year, Mr Gradwell and Ms Masters from ANZ said: “Indeed, we do not expect the RBA to hike rates until 2019, and then by only 50bp [basis points] in the year which is unlikely to hit affordability in a material way. Moreover, most households continue to hold a solid buffer.”

So no need to buy into the "hype" of a market crash any time soon. Be pragmatic and be wary - as I mentioned in my April market update for Sydney, there is a big difference between what is happening in different regions and for different types of stock. By that I mean that 'A Grade' property is still selling really well, 'B Grade' is selling ok and 'C Grade' not very well at all. So if you're after the 'A Grade' stock, you're still going to be facing competition, but against two or three others instead of six or seven last year.

A good Buyer's Agent is worth their weight in gold at present so feel free to give me a call direct on 0419 200 018 for a confidential chat in regards to your next purchase.

Information sourced from Domain article "Five graphs that show what's next for the property market" by Chris Kohler on 5/4/18.